Next Available Date

Weekday Training

Monday 13th May 2024

Pass CeMAP® quickly and confidently with our excellent CeMAP® Training Courses

Embark on your journey to become a successful Mortgage Advisor with Futuretrend Financial Training! Our passion lies in providing exceptional CeMAP Training Courses that are both high quality and affordable. Since 2006, we have been empowering aspiring professionals like you to achieve their goals, boasting an impressive track record of first-time exam success.

When you choose us as your CeMAP training provider, we prioritise building a lasting relationship based on trust. We understand the significance of your first steps into the Mortgage/Financial Advisor industry, and we are committed to exceeding your expectations every step of the way.

Our comprehensive CeMAP® training courses cater to individuals from various backgrounds - whether you're new to the Mortgage Industry or seeking additional support to become CeMAP® qualified with your existing knowledge in Mortgages/Finance.

Join us for a 10 day CeMAP crash course. Immerse yourself in the vast CeMAP® 1, 2 & 3 syllabus. We ensure that you will gain the knowledge and skills needed to excel in your CeMAP® exam.

Virtual classroom

CeMAP Experience

Thousands of learners have completed their CeMAP training with us as we have over 23 years of experience in providing high quality training and support.

CeMAP Knowledge

All our trainers and consultants have years of experience in their field to support and guide you towards your new career.

CeMAP Accredited

Our learning support is recognised by the LIBF as being appropriate additional resources for students undertaking its CeMAP qualifications.

Mortgage Advice Qualifications

Certificate in Mortgage Advice & Practice (CeMAP®)

Entry Level 3

The FCA benchmark qualification for budding mortgage advisers. This course is perfect for new entrants to the Financial Services sector.

Read More

Certificate in Regulated Equity Release (CeRER®)

Specialist Level 3

The ideal qualification to follow CeMAP. Once you hold CeRER you are fully qualified to offer advice within the rapidly growing equity release market.

Read MoreStudy Options

Virtual Classroom Training

All our Virtual Classroom courses are Live and interactive with both the tutor and other learners in attendance

Read More

Home Study Training

For the independent and self-motivated learner, our CeMAP home Study course comes with everything you need to succeed with your CeMAP exams papers 1, 2 & 3

Read MoreMenera | Housslow

Yes...I passed all 3 exams! thanks for all your help and support. Though I was doubtful of making the journey all the way across London for the whole 10 days of training I'm glad I stuck with it... in the end it has been well worth it.

Andrews | Aberdeen

passed my final cemap 3 exam today so I'm now fully qualified I would like to thank all at future-trend and a big mention to David His course was really good and helped me a lot to understand points It was also a very good laugh and I would recommend futuretrend and David to anyone in the future Plesse let me know when the equity release course is starting as I wish to do that Also

Greg | RomFord

I'm not sure if you remember me but I took the CeMAP course recently, CeMAP 1 in December and CeMAP 2&3 in February, and I wanted to personally thank you for your excellent tutoring without which I wouldn't have been able to pass the modules, which I have now done, I'm starting officially as a mortgage consultant on the 3rd June and am looking forward to a new chapter in my career.

Andrews | Aberdeen

passed my final cemap 3 exam today so I'm now fully qualified I would like to thank all at future-trend and a big mention to David His course was really good and helped me a lot to understand points It was also a very good laugh and I would recommend futuretrend and David to anyone in the future Plesse let me know when the equity release course is starting as I wish to do that Also

Menera | Housslow

Yes...I passed all 3 exams! thanks for all your help and support. Though I was doubtful of making the journey all the way across London for the whole 10 days of training I'm glad I stuck with it... in the end it has been well worth it.

Greg | RomFord

I'm not sure if you remember me but I took the CeMAP course recently, CeMAP 1 in December and CeMAP 2&3 in February, and I wanted to personally thank you for your excellent tutoring without which I wouldn't have been able to pass the modules, which I have now done, I'm starting officially as a mortgage consultant on the 3rd June and am looking forward to a new chapter in my career.

Accredited CeMAP® Learning Support Provider

Learner Testimonials

We like to collect feedback from our learners not only to help us develop our courses to offer the best training possible, but it lets you see for yourself what out learners say about us and their experience they recieved.

Why CeMAP® now?

The mortgage market is really beginning to pick up. In recent years the property market has seen an extraordinary level of growth with more and more people buying and re-mortgaging properties for residential use or investment purposes.

As such, there are now many reasons to invest in a recognised CeMAP training course, take your CeMAP® Exams and qualify as a mortgage advisor:

- Thousands of mortgages are being approved every month.

- Many brokers are making money by selling protection products i.e life insurance, mortgage protection,re-mortgages.

- The market is definitely making a come back .... the only question is will you already be on the wagon or are you going to be chasing it after it's left the station?

The CeMAP® qualification, or equivalent, is a prerequisite for anyone providing mortgage advice. CeMAP is a nationally-recognized RQF level 3 qualification.

- 2004, the FSA (now FCA) regulated the Mortgage Market

- No one is allowed to give advice if he / she is not suitably qualified

- The numbers of qualified people are only a QUARTER of the actual demand

What is CeMAP® ?

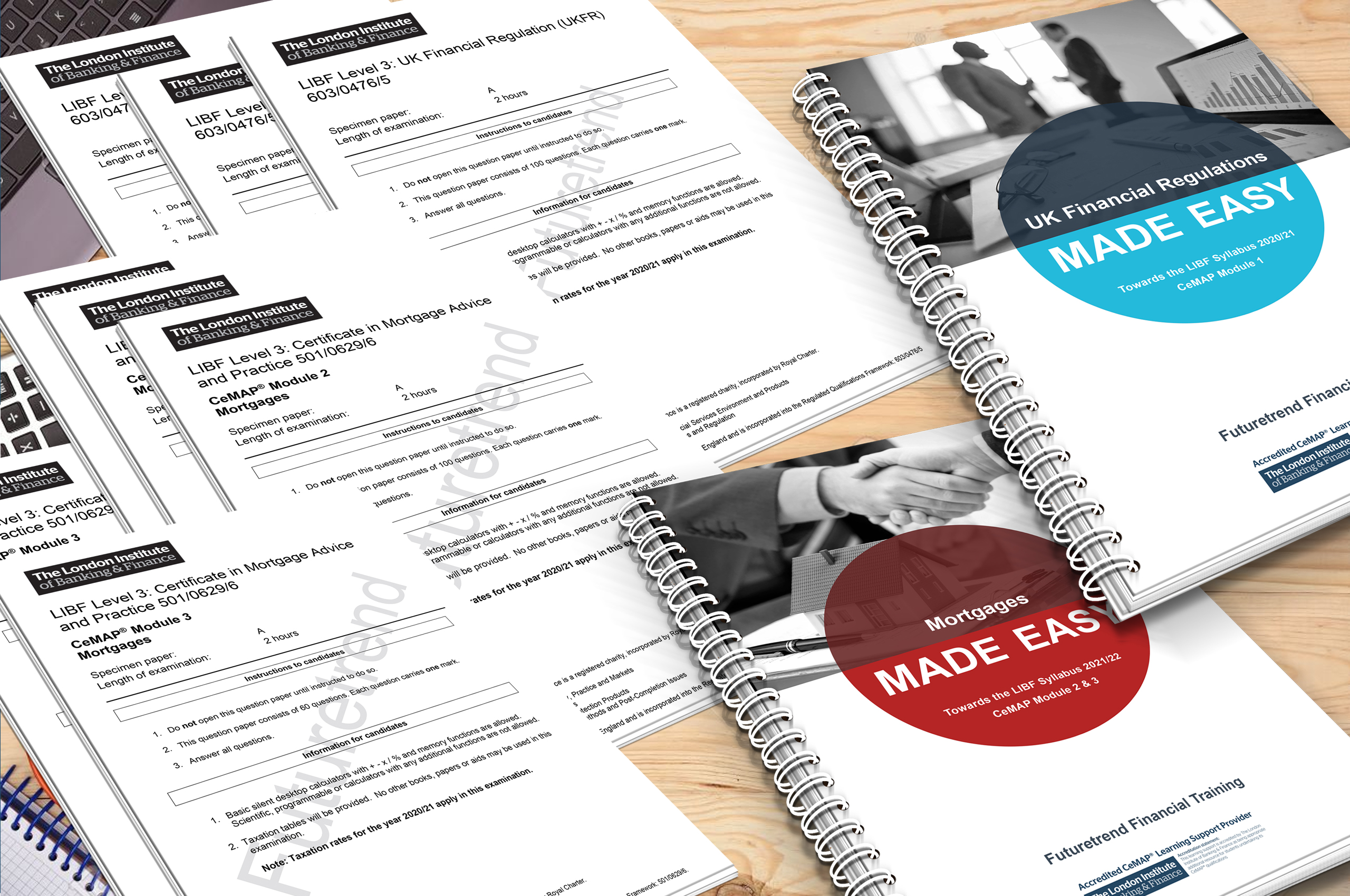

The Certificate in Mortgage Advice and Practice (CeMAP®) is a recognised qualification awarded by The London Institute of Banking & Finance.

The CeMAP® qualification, or equivalent, is a prerequisite for anyone providing mortgage advice. CeMAP is a nationally-recognized ROF level 3 qualification.

- CeMAP® - the Mortgage Advisors Qualification

- 3 papers - Multiple choice

- 100 questions for CeMAP® 1 & 2

- 60 questions for CeMAP® 3

- Exams can be taken at your convenience

The CeMAP® Qualification

Under FCA rules it is compulsory to hold an appropriate qualification if you wish to give advice on mortgages. The Certificate in Mortgage Advice & Practice (CeMAP), awarded by The London Institute of Banking & Finance, is a Level 3 qualification registered with Ofqual in the Regulated Qualifications Framework (ROO. It meets the FCA examination standards for providing advice on mortgage products.

Most importantly, it is recognised by the Financial Conduct Authority (FCA) as an appropriate qualification. The CeMAP® qualification is made up of 3 modules, all of which must be completed to achieve the qualification.

- CeMAP® module 1: UK Financial Regulation.

- CeMAP® module 2: Mortgages.

- CeMAP® module 3: Assessment of Mortgage Advice Knowledge.